The 'Declare Tips' function on the Upserve POS will require employees to enter the total tips that they are declaring when they Clock-Out. This feature will help your payroll staff and restaurant employees to keep track of all tips that need to be declared to the IRS. Declared tips do not add to the total tips that your entered into the Upserve POS and is only intended to keep a record of the tip amount that will be reported to the IRS.

| Why Should I Claim My Tips? Click here to learn why you should claim your tips and how to report tips to the IRS. We also recommend consulting a tax specialist if you have questions about declaring tips to the IRS. |

Turn on Declare Tips

How to Declare Tips on the Upserve POS

Declare Tips Reporting

Turn on Declare Tips

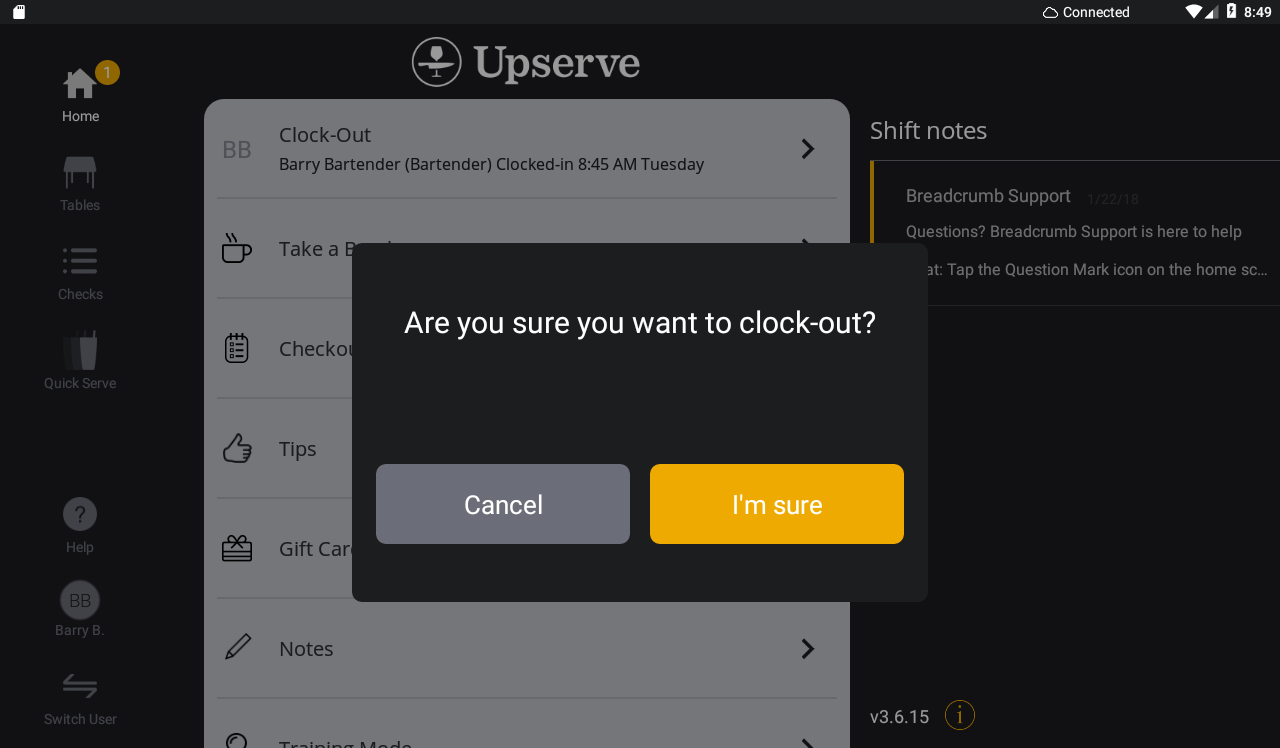

If you would like your employees to declare their tips when they

Clock-Out of the Upserve POS,

you will need to turn on the 'declare tips' role permission for each Point of Sale Role that should declare tips (Ex: Server, Bartender, Barback, etc).

- Log in to HQ (or tap Employees from the Upserve POS Home Screen)

- Click Users & Roles

- Select Roles > Point of Sale

- Click on the Role you wish to edit

- Scroll down to 'Allow Members Of This Role To'

- Check 'Declare tips when clocking out'

- Click Save

- Repeat for any other Point of Sale Roles that require this permission

How to Declare Tips on the Upserve POS

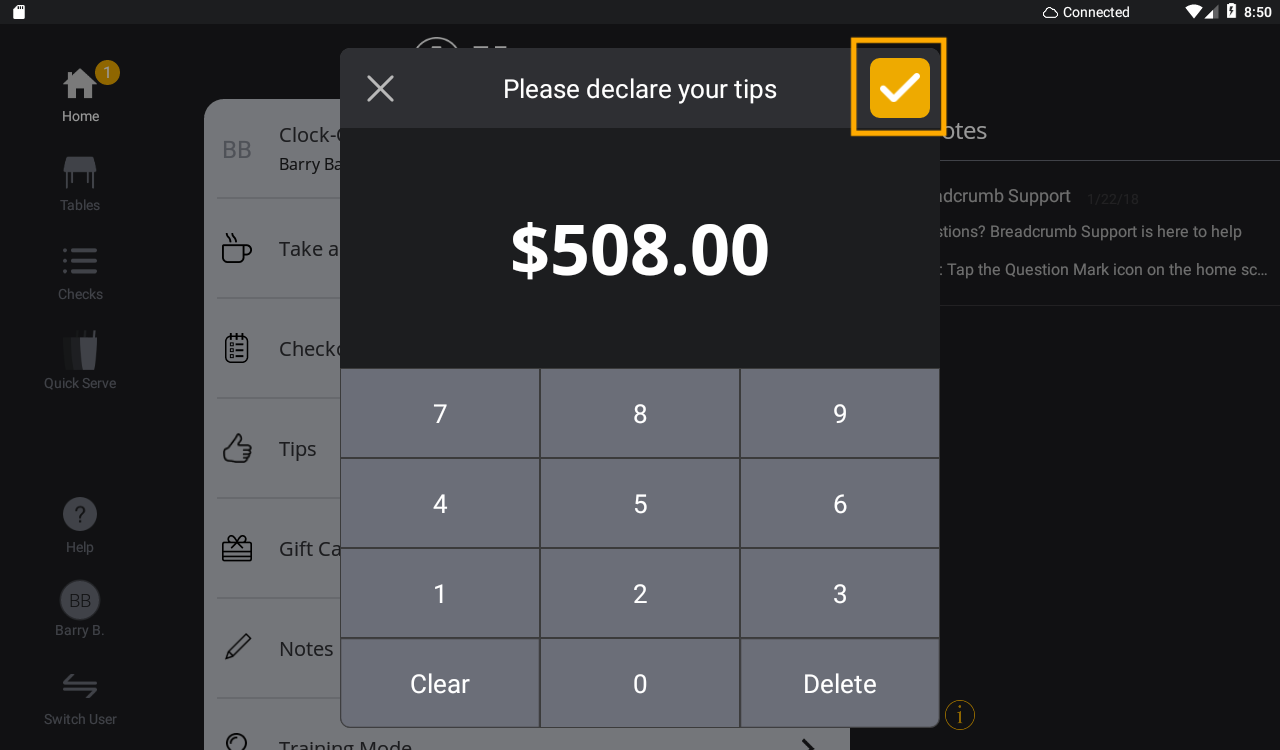

When a user's role has the 'Declare Tips' permission turned on, they will need to enter their declared tips when they Clock-Out on the Upserve POS. Declared tips should include all collected tips (cash, credit card, other tender). Employees can run their Checkout Report to view their 'Total Tips' collected for that shift and declare the total tip amount or another amount of their choosing. In the Labor Report, total tips and declared tips will report separately.

| Note: The IRS requires any server who is tipped more than $20 per day to declare their tips. Declaring tips properly helps ensure when tax season rolls around, you don’t owe large sums of money. It also helps you take out loans for big ticket items and avoid audits. Employees can enter any tip total they wish to declare, but it is recommended to declare total tips per shift. We recommend consulting a tax specialist if you have questions about declaring tips to the IRS. |

- Clock-In to your shift and work your shift

- Before you Clock-Out, tap Checkout Report

- Tap Print to print your checkout report

- Note the Total Tips you collected

- Use the keypad to enter your 'Declared Tips' (Enter your Tip Total or the amount you wish to declare)

- Tap the orange check mark to save

Declare Tips Reporting

Employees' declared tips will be reported in the

Labor Report.

'Total Tips' and 'Declared Tips' will report separately, since 'Total Tips' reflects the amount of cash, credit card, and other tender tips entered into the Upserve POS and 'Declared Tips' reflects the tip amount that will be reported to the IRS.

- Log in to HQ

- Click Reports > Labor Report

- In Employees and Timecards 'Total Tips' and 'Declared Tips' will be listed on the far right columns for each employee

The

Sales and Payments Reports will only show 'Total Tips' (cash, credit card, other tender) entered into the Upserve POS and will not show declared tips.